Should I buy or lease gym equipment for my business?

The decision to buy or lease commercial gym equipment depends on the amount of capital you have and your tax situation. There are pros and cons to both approaches. Leasing allows you to change out fitness equipment every few years while incurring lower maintenance costs, and payments are generally deductible as a business expense. It is also easier to obtain leases than equipment loans. They may, however, cost your health club more money in the long-term. New gym equipment loans though, now offer better tax advantages due to the revised Tax Cut and Jobs Act of 2018 but still saddle you with a fixed, depreciating asset.

Regular Equipment Replacement

One of the biggest benefits to leasing, apart from the obvious lower amount of capital outlay required, is that you can change out your equipment every few years. Having brand new equipment is definitely a plus when it comes to customer satisfaction, and they’ll think you’ve spent a fortune. You should have lower maintenance costs and less equipment down time as well, if you choose your manufacturer and vendor wisely.

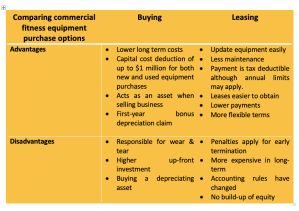

Advantages and disadvantages to buying vs leasing gym equipment

Tax Considerations

The Tax Cuts and Jobs Act of 2018 significantly increased tax advantages for small business deciding between buying and leasing gym equipment. Your lease payments can generally be deducted on your tax return, which will reduce the overall net cost of your lease. On the other hand, due to TCJA the maximum deduction for the purchase of most types of qualified equipment has doubled from $500,000 to $1 million for businesses that spend less than $2.5 million per year on business equipment. Included in this mix is an incentive for buying used business equipment as well.

There is also a first-year bonus depreciation deduction available for property placed into service from 2018 to 2022. The depreciation deduction will be phased out starting in 2023 and end in 2026. You need to consult with a tax accountant to decide which option would be more beneficial for your particular situation.

Financing Considerations

Leases are easier to obtain and give you more flexible terms than equipment loans, which can be a significant advantage if you have poor credit or need a longer payment plan. You may be stuck with a lease, however, or pay high penalties if your gym should fail and you no longer need the equipment. You’ll also be stuck paying off purchased equipment, but at least you can sell it.

Higher Overall Cost

Leasing equipment is always more expensive than purchasing it, in the long run. Those more flexible terms do come with a price. Also, you never build any equity in the equipment. If you choose to purchase your gym equipment, eventually you own it, and it can be a significant part of the asset, should you decide to sell your facility. On the other hand, accounting for wear and tear as time goes by, the equipment may not be worth all that much.

Considering the high cost of opening a gym, and the need for extensive financing, for most new gym owners leasing is the way to go. Leasing equipment allows you to always have the latest and greatest for your customers, without all the maintenance headaches.

However, although this blog originally recommended leasing when it first published in 2013, with the advent of the TCJA, we suggest owning your gym equipment might be a good idea. Although buying equipment does carry the risk of breakdowns and obsolescence, purchasing used gym equipment may make this choice easier at this time.

As we’ve detailed in other blogs, there are many good reasons why you should buy used gym equipment and this legislation provides one more incentive to own your fixed assets.

The solution to buying or leasing fitness equipment

A workable compromise might be to purchase free weights, benches and fixed equipment, and then lease all the stuff with the moving parts that tends to break down more easily! Talk to your accountant first to see how this TCJA affects your decision.

Gym Insight

Of the many decisions an owner has to make, choosing which gym software to use may be one of the most critical. With Gym Insight, our gym management software provides a clear, transparent picture into your company’s financials and member base. Our software is built in-house, by fitness club owners. There are no cumbersome third-party plug-ins or complicated protocols, and it’s available for a single, low monthly subscription price — no hidden fees, no links to your payment processor. Call us today for a free demonstration on how we can lower your software management costs and free up more of your capital!

This blog has been updated and first ran February 26, 2013 and modified Jan. 12, 2021